1199SEIU dues are a percentage of employees’ wages, so every time employees get a raise, the union may collect more from them. The amount union workers must pay is determined by 1199SEIU rules and could increase over time.

For example, someone paid $26 an hour would owe dues of about $90 a month. That’s about $1,080 per year. And that means it’s almost $3,250 over a typical 3-year contract.

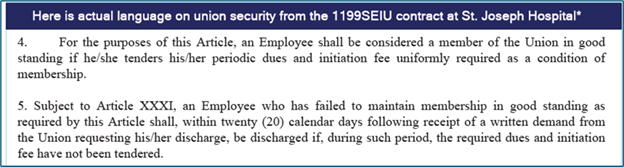

Union Security

1199SEIU labor contracts generally require unionized employees to pay union dues or fees to keep their jobs with their employers.

1199SEIU Dues

2%

-

of monthly wages up to $100 per month (up to $125 per month for higher paid employees)

Maximum dues per year

up to

$

1,200

-

($1,500 for higher paid employees)

Total dues over a 3-year contract

up to

$

3,600

-

($4,500 for higher paid employees)

Dues Calculator

Use the dues calculator below to determine the amount of dues you could owe 1199SEIU every month.

Estimated union dues per month: $

Estimated union dues per year: $

Estimated union dues over 3 year contract: $

Union Security

1199SEIU labor contracts generally require unionized employees to pay union dues or fees to keep their jobs with their employers.